pg.

14

Asia Media Group Berhad

►

Annual Report 2015

While the DOOH transit media industry have illustrated a downtrend in 2014 due to lower

advertising expenditure as a result of the anticipation of a slower economic growth in Malaysia

in 2015, the DOOH transit media is expected to recover and project healthy growth rates in the

long-term.

Smith Zander International Sdn Bhd forecasts the DOOH transit media industry to grow

moderately at a CAGR of 6.0% between 2015 and 2017. This growth is expected to be driven

by the continuous decline in digital screen prices and increasing acceptance of audio/visual

transit media advertising as a medium that can effectively attract and retain viewer’s attention,

as well as the implementation of Government initiatives through the National Land Public

Transport Master Plan (2012-2030) that aims to further increase public transport modal share

for urban areas to 40% by 2030. As such, the DOOH transit media industry size is projected to

grow from an estimated RM23.4 million in 2015 to reach RM26.3 million in 2017. Higher growth

is anticipated in 2017, in light of improving economic conditions in Malaysia.

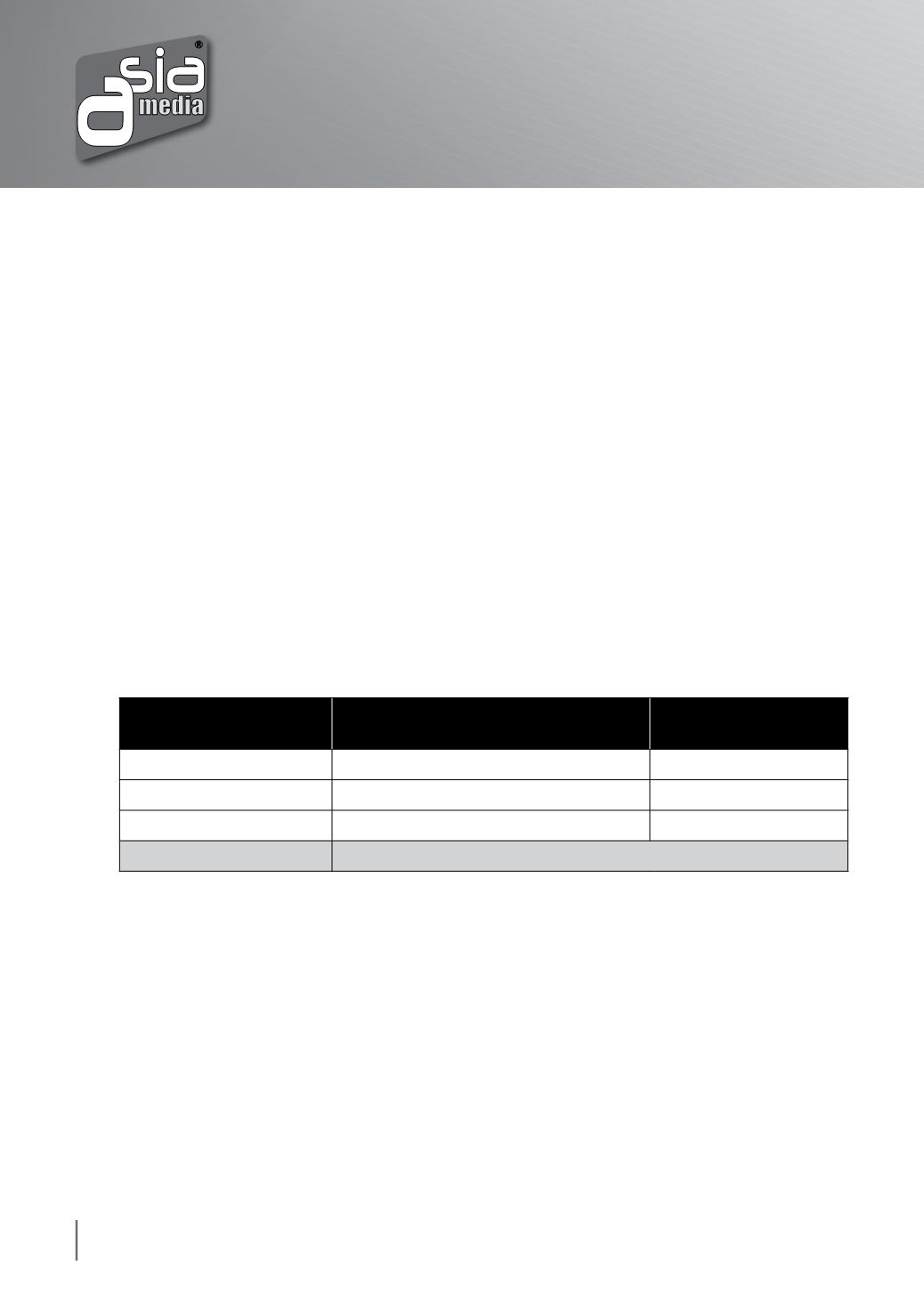

DOOH Transit Media Industry (Malaysia), 2015(e)– 2017(f)

Year

DOOH Transit Media Industry Size

(RM million)

Growth Rate

(%)

2015(e)

23.4

2016(f)

24.1

3.0%

2017(f)

26.3

9.1%

CAGR (2015(e)-2017(f))

6.0%

Source: Surahanjaya Syarikat Malaysia

(Source: Overview and Outlook of the DOOH Transit Media Industry in Malaysia, 2016, Smith

Zander International Sdn Bhd)

III. Overview and outlook of the palm oil industry

The upstream palm oil industry in Malaysia is mature owing to its long history of cultivation and

processing of palm oil and Palm kernel oil (“PKO”). Nevertheless, growth opportunities are present

as replanting is regularly carried out to replace mature crops to ensure the sustainability of supply

of palm oil and PKO to the refineries. The downstream segment of the palm oil industry is robust

as a result of the constant supply of oilseeds from the plantation sector and strong consumer

demand. This strong demand from retail and industrial consumers is expected to secure the

sustainability of Malaysia’s palm oil industry over the long term.

Management Discussion and Analysis

(continued)