Annual Report 2016

ASIA MEDIA GROUP Berhad

13

INDUSTRY OUTLOOK AND FUTURE PROSPECTS OF OUR GROUP (CONT’D)

II.

Overview and outlook of DOOH transit media industry (cont’d)

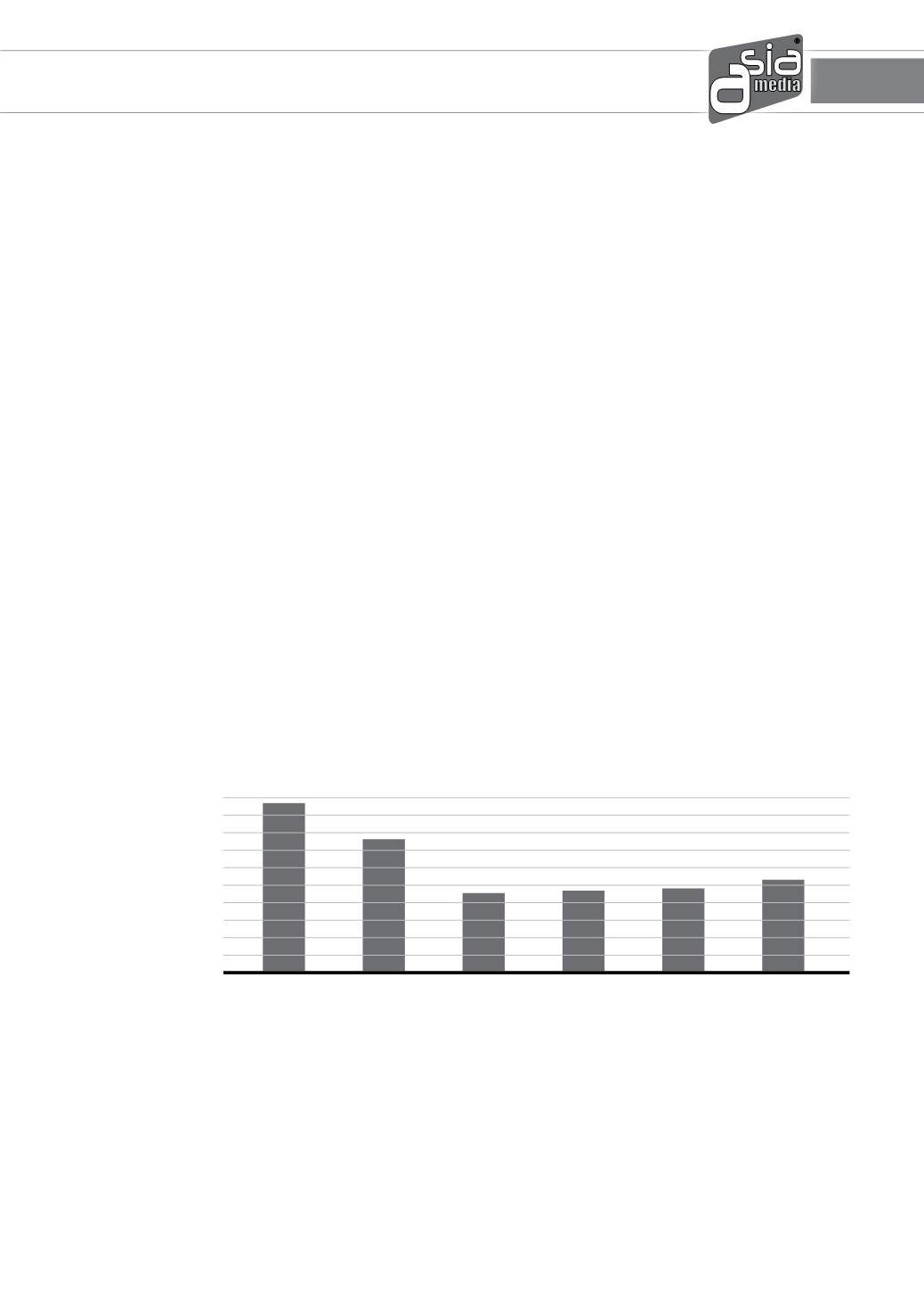

The DOOH transit media industry size in Malaysia was exceptionally high in 2012, largely owing

to an increase in advertising expenditure in the year due to the Union of European Football

Associations (UEFA) EURO 2012 and the London Olympics, coupled with Government initiatives

to upgrade and rehabilitate existing public transportation infrastructure through the 10th Malaysia

Plan (2011-2015), with an aim to increase public transport modal share from 12% in 2009 to

30% in 2015. Some of the initiatives highlighted included 470 new buses for Rapid KL, Rapid

Kuantan and Rapid Penang, nine (9) bus express transit corridors for Greater Kuala Lumpur/

Klang Valley, 35 four (4)-car sets for Light Rail Transit (Kelana Jaya line), 38 six (6)-car sets for

Keretapi Tanah Melayu (KTM) Komuter, twelve (12) four (4)-car sets for Kuala Lumpur Monorail

(KL Monorail), as well as establishing a command and control centre and a Performance

Monitoring Hub System to monitor performance of all bus operators in Greater Kuala Lumpur/

Klang Valley. The DOOH transit media industry in Malaysia entered into a correction phase in

2013 and 2014, registering an industry size of RM37.7 million in 2013 and RM22.6 million in

2014.

Moving forward, the DOOH transit media industry in Malaysia is projected to grow from an

estimated RM23.4 million in 2015 to reach RM26.3 million in 2017, at a CAGR of 6.0%

DOOH Transit Media Industry (Malaysia), 2012 – 2017(f)

Source: Surahanjaya Syarikat Malaysia

While the DOOH transit media industry have illustrated a downtrend in 2014 due to lower

advertising expenditure as a result of the anticipation of a slower economic growth in Malaysia

in 2015, the DOOH transit media is expected to recover and project healthy growth rates in the

long-term.

DOOH Transit Media

Industry

Revenue

(RM million)

2012

47.4

2013

37.7

2014

22.6

2015

(e)

23.4

2016

(f)

24.1

2017

(f)

26.3

0

5

10

30

20

40

15

35

25

45

50

Management Discussion and Analysis

(continued)